Good morning!

Yesterday, the RBA board left rates unchanged. Let’s get into their decision. But first, a follow-up to Sam’s story on the weekend about jobs.

Also, full respect to the RBA board, but if I were PM, here’s who I’d appoint: Joseph Suali’i, Ray Gun, The Kid Laroi, Kath and Kim, Russell Crowe, and Robert Irwin.

P.S. you might've noticed that our message from EatClub last week was out of date, you can find the correct version of the message in last week's newsletter here!

Your questions, answered

Question: Why do we need jobs?

Last week, Sam wrote this cool story about why young people change jobs. We change jobs or careers more frequently than older people; we seek purpose in our work, struggle with cost-of-living pressures, study longer, and our job market offers more non-full-time opportunities than in the past.

But reading it got me thinking about a more fundamental question: why do we need jobs at all? And once we have them, what makes some jobs "good" while others... well, aren't?

First, what the government wants

The Australian government has a specific goal for our job market: sustained and inclusive full employment.

What does that mean? Full employment means everyone who wants a job can get one without having to search for too long. "Sustained" means this situation lasts over time - it's not just a temporary blip. And "inclusive" means the benefits reach all groups in society, not just some.

In short, it’s good for the government (and good for you) if you can find a decent job that pays fairly, and offers some security. Here’s why.

No, it’s not because the government wants you to be happy

(But I’m sure they’re thrilled if you are). Full employment helps the government achieve three key objectives:

Economic growth: More people working means more goods and services are produced, increasing growth (Remember two weeks ago: growth means higher incomes, more stuff, better living standards. Growth = good).

Budget benefits: More people employed means the government collects more from all of us in the form of income tax and pays out less unemployment benefits. More money coming in, less going out. They can use that extra cash to improve education, healthcare and other public services we all use.

Social wellbeing: For most of us, work isn't just about money - though that's obviously important. Meaningful work gives us identity, purpose, and social connections. It's also our primary source of income, which helps reduce poverty and maintain social stability.

So, how’s the Australian jobs market?

The Australian jobs market is looking almost as good as it's ever looked.

The unemployment rate (that's the percentage of people who want a job but can't find one) was 4.1% in May 2024. The underemployment rate (the percentage of people working fewer hours than they want to) was 5.9%. Both of these are near historically low levels.

At the same time, our labour force participation rate (the percentage of working-age people aged 15 to 64 who are either working or actively looking for work) stands at 67%. That's close to historically high levels.

The bottom line: A lot of us want to work, and of those who want to work, most of us have jobs.

But Max… how do we know if we have GOOD jobs?

This is where things get more interesting. Having a job and having a good job (and figuring out how to measure how ‘good’ a job is) are very different things.

Ultimately, it’s subjective (sorry, lame answer). But there is some financial data we can look at that gives us clues as to how people are feeling about their work.

In a few weeks, the Australian Bureau of Statistics is going to release the Job mobility report for 2024. Think of it like a health check for the jobs market. It will tell us things like:

How long people stay in their jobs on average

Which industries are creating the most new positions

How often we're changing jobs (and why)

Which sectors are gaining and losing workers

It’s cool data. When it drops, I'll break down what it means for you and the broader Australian economy - we'll look at which jobs are hot, which are not, and what trends might shape your career in the coming years. It’s really important to remember that the job market isn't just about statistics - it's about your future earning potential, career satisfaction, and quality of life.

The more we understand it, the easier it will be to navigate.

A message from EatClub

Don’t have a mortgage but still feeling the squeeze? Same.

Even if you’re not dealing with interest rate hikes on a home loan, RBA decisions can still hit where it hurts - like your rent, groceries, and yes, your social life.

That’s where EatClub comes in. It’s a free app that gives you up to 50% off at thousands of restaurants and bars across the country. Just find a deal, pay with your EatClub card, and the discount applies automatically.

Because you shouldn’t have to give up dinner plans just because the cash rate moved (again).

Plus, in July, every time you redeem an EatClub deal after your first, you’ll unlock extra savings on your bill. That means the more you dine, the more you save.

The week’s biggest finance headline, explained

Why did the RBA hold rates steady?

By now you’re all cash rate and inflation experts. But in case you’re new here, here’s a crash course.

The Cash Rate Crash Course (say that ten times)

The RBA's job is to manage the economy - specifically, to keep unemployment low and inflation between 2-3% per year. Their main tool? The cash rate, which is the interest rate banks charge each other for borrowing money overnight.

When the RBA increases the cash rate, it becomes more expensive for banks to borrow from each other. Banks pass this cost on to you through higher interest rates on your mortgage, car loan, credit card - basically any money you've borrowed.

Higher interest payments mean less money in your pocket for everything else. With less disposable income, you spend less on goods and services. Less spending across the economy means less demand, which puts less upward pressure on prices. Result? Inflation falls.

The reverse happens when the RBA cuts rates - borrowing becomes cheaper, you have more disposable income, spending increases, demand rises, and inflation tends to go up.

If that makes sense, give me 5 stars. If it makes no sense, or you find anything confusing, give me 1 star. Please don’t though.

So, why didn’t rates move?

The cash rate isn't like a light switch the RBA can flick on and off to instantly control inflation. It's more like a dimmer switch - they make gradual adjustments to fine-tune the amount of demand in the economy.

Think of it this way: imagine the Australian economy is a long-distance runner, and the RBA is her coach. She's talented, but not always great at pacing herself. Sometimes she runs too fast and risks burning out. Other times she slows down too much and falls behind - not because she's careless, but because the course keeps changing. Hills, headwinds, tailwinds, and weather all affect her performance without much warning.

Her coach (the RBA) has a map of the course, knows the weather forecast, and watches her closely for signs of fatigue or overexcitement. To help her maintain a steady, sustainable pace, Coach RBA makes strategic interventions. She might hand her an energy gel before a tough hill, or hold up a big ‘SLOW DOWN’ sign before a big downward cruise so she doesn’t go flying.

And sometimes, if she's running at a steady, sustainable pace, she just lets her keep going. If she's unsure what's around the corner, she might hold off making any moves - better to wait and see what’s around the corner than risk making the wrong call.

How this works IRL

Yesterday, the RBA held rates steady not because all our economic problems are solved, but because they're essentially in wait-and-see mode.

The good news: Inflation is back within the 2-3% target range after being uncomfortably high for a couple of years. That's a big win.

The not-so-good news: there’s still uncertainty hanging around, primarily due to the unpredictable movements of U.S. trade policy and tariffs, and there aren’t many jobs available (the labour market is still extremely tight).

When the RBA releases its minutes from yesterday’s meeting in a few weeks, we can break them down together and see how our presumptions stack up.

A titbit for your group chat

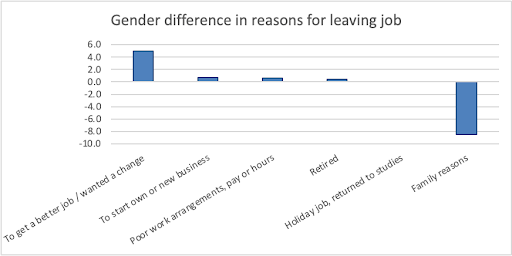

To get you interested in the 2025 Jobs Mobility report data, here’s a chart from the 2024 report. It tells you the difference in percentage points between men and women when it comes to the reasons for leaving a job.

Nearly 30% of men who left their jobs in 2024 did so for a better job, but only 25% of women left for this reason (i.e., a five percentage point difference). And nearly 13% of women left for family reasons, compared to only 5% of men.

Note: Chart shows the percentage point difference between men and women for the reasons they left work in 2024. Source: Australian Bureau of Statistics, Job Mobility February 2024

TDA asks