Happy Wednesday!

How much is too much to pay for a single Pokémon card?

Well, according to venture capitalist AJ Scaramucci, about $US16.5 million ($AU23.3 million). That’s how much he paid social media star Logan Paul at auction yesterday, setting a world record for any trading card sold at auction.

The Pikachu Illustrator card, designed for a 1998 contest and one of only a few dozen believed to exist, was purchased after 41 days of bidding. Paul originally bought the card in 2021 for $US5.2 million and wore it in a diamond necklace at WrestleMania 38.

What a time.

I’ve got 1 minute

Wall Street CEOs are being paid record salaries. Why?

Wall Street bosses are earning record salaries, bringing home pay similar to what they were just before the global financial crisis (GFC) in 2008.

The heads of six of the U.S’ biggest banks earned over $US40 million ($AU56.5 million) each last year.

Goldman Sachs CEO David Solomon topped the list, with recent filings showing he earned a $US2 million base salary with an additional $45 million in shares, cash, and interest last year.

That’s more than a 20% pay rise from 2024.

JPMorgan’s Jamie Dimon was paid $43 million last year after earning the same amount as Solomon in 2024.

CitiBank’s Jane Fraser, the first woman to lead a major U.S. bank, earned a total of $42 million last year. That's a 22% annual raise, making her one of the highest earning female CEOs in the U.S.

Morgan Stanley paid CEO Ted Pick $45 million, Bank of America’s Brian Moynihan earned $41 million and Wells Fargo’s Charles W. Scharf brought home $40 million for the year.

All of these executives averaged a 20% pay rise in 2025. Meanwhile, U.S. workers’ wages rose 3.75% last year.

These six banks alone paid out over $250 million in CEO salaries, beating previous records set in 2006 and 2021, according to Bloomberg.

The record salaries follow one of the strongest years on record for Wall Street. Large parts of the CEOs’ compensation is in stock in the companies they run, which aligns their personal financial interests with those of the shareholders.

Citibank’s share price has increased significantly under Fraser, who reversed fortunes for a bank that had long been seen to lag behind its competitors.

Goldman Sachs set a Wall Street record of $4.31 billion in equity trading revenue, boosted by its banking and markets department in the final three months of last year, while its share price rose by 50% in 2025.

The bank also offered Solomon an $80 million retention bonus in stock if he stays in the top job until at least January 2030.

Goldman Sachs paid Solomon’s predecessor, Lloyd Blankfein, a record $68.5 million in 2008, after the bank correctly bet on the collapse of the U.S. housing market which led to the GFC.

Reporting by Lachlan Keller.

Investing basics, brought to you by CommSec

Transparency: This is a sponsored section of the newsletter. It's the best way we can keep this newsletter free for you.

Information is general in nature. Consider the T&C’s and other fees and charges at commsec.com.au before making a decision. Investing carries risk.

What’s an ETF?

An ETF (Exchange Traded Fund) lets you invest in many companies or assets at once, instead of picking individual shares.

Passive ETFs track a market index like the S&P500 - an index of the top US companies. Active ETFs are picked by expert fund managers and thematic ETFs focus on trends, sectors or commodities like tech, lithium, or gold. You can buy ETFs through an online broker, usually with a small fee.

ETFs are popular as you’re getting exposure to stocks that are often crowd favourites and are easy to trade.

Ready to learn more? The CommSec Invest podcast breaks it all down - listen to all episodes here.

I’ve got 2 minutes

The first of two trials against Australia’s supermarket giants has begun in the Federal Court

Supermarket giant Coles has been accused of misleading customers on the first day of a Federal Court trial.

The Australian Competition and Consumer Commission (ACCC) is suing Coles over claims it breached consumer law by using “illusory” discounts. Coles denies wrongdoing.

It is the first of two cases against Australia’s major supermarkets. A trial against Woolworths will begin later in the year.

The consumer watchdog alleges both retailers “derived significant revenue” from selling “millions” of deceptively priced products.

Background

Coles and Woolworths control around two-thirds of the supermarket sector.

In the 2025/26 financial year, Coles reported a net profit of $1.1 billion.

In September 2024, the watchdog announced it was suing the major supermarkets in separate lawsuits.

The ACCC analysed the price of hundreds of Coles grocery items from February 2022 to May 2023, and accused the supermarket of using misleading pricing across 245 products.

Claims

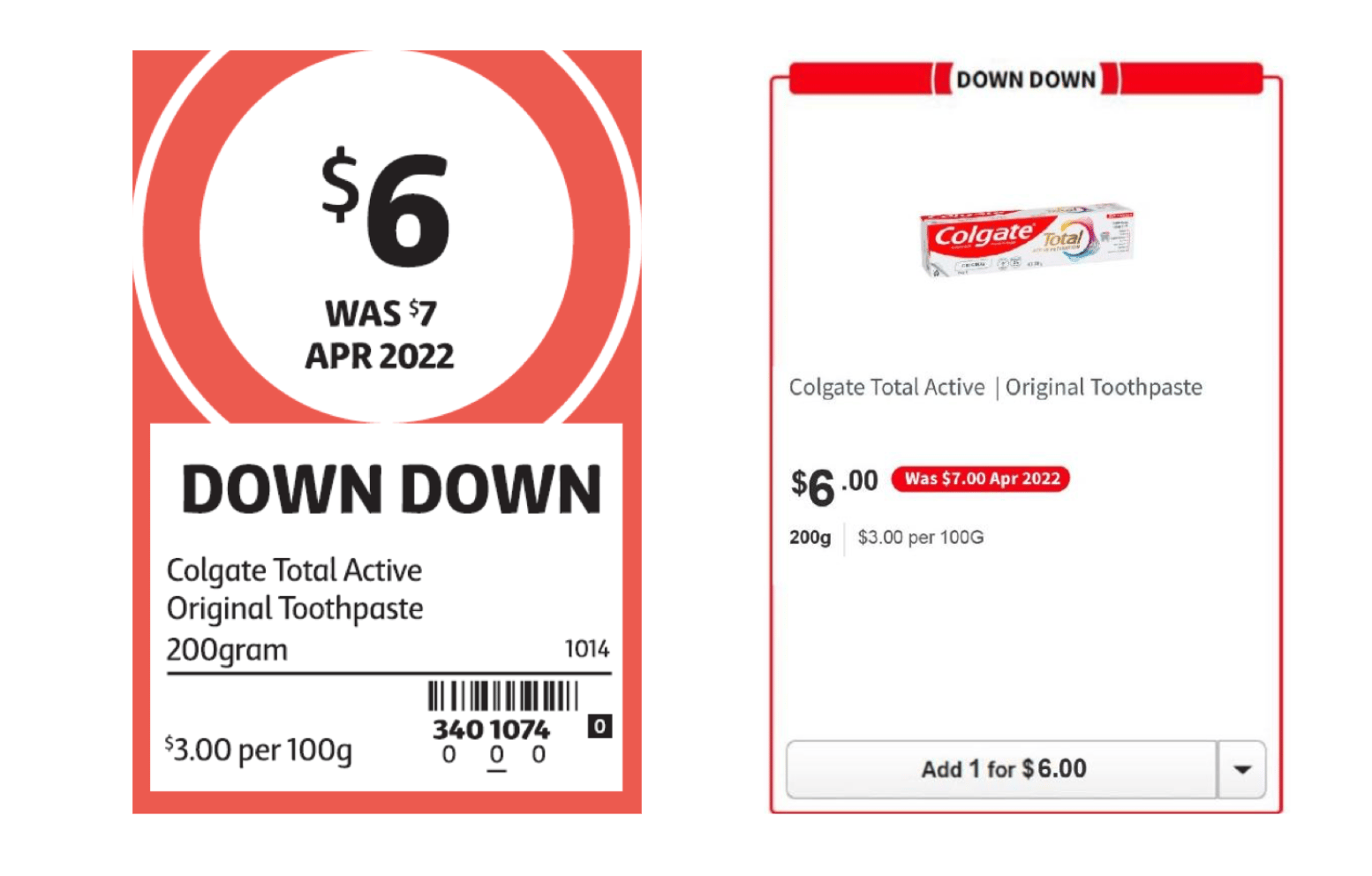

The ACCC accused Coles of “price spiking” several of its products — a practice where the price of an item is increased briefly before it’s ‘reduced’ to a price that is more expensive, or the same as, before the spike.

For example, Coles sold Strepsils Honey & Lemon Lozenges for $5.50 for around two years. It increased the price to $7 in October 2022.

The next month, the Strepsils were advertised with the supermarket’s “Down Down” discount label for $6.00 — $0.50 higher than the original price.

The “Down Down” promotion has been running at Coles since 2010.

It advertises discounted prices on items for sustained periods of time, rather than short-term sales.

The tickets look like this:

Trial

The trial began in the Federal Court on Monday, with the ACCC accusing Coles of using its “price spiking” and its “Down Down” tags to unlawfully mislead customers.

On day one of proceedings, the ACCC’s barrister Garry Rich SC told the court: “Why on earth are you telling your customers that your prices are going down, when they’re not?”

He called the “Down Down” campaign “an utterly inappropriate promotional mechanic to use in circumstances where everyone within Coles knows the price is going up.”

The ACCC website includes examples of “ways that a displayed price can be misleading”. This includes: “Stating the sale price is marked down from an earlier price when:

The items were not sold at that price for a reasonable period right before the sale started, or

Only a very small proportion of items were sold at that price right before the sale.”

Part of this case will include determining what a “reasonable period” is.

Defence

Coles has rejected the ACCC’s claims.

Its defence is expected to centre on supplier costs. Coles will also argue that 245 products identified by the ACCC were temporarily removed from the “Down Down” promotion.

In November 2024, the supermarket said the affected products were “sold at the non-promotional price... for up to six weeks,” before re-entering the “Down Down” program.

In opening arguments, lawyers for Coles said customers were aware of price fluctuations before purchasing products.

What’s next?

The ACCC is seeking “significant” cost penalties for Coles.

It will also seek mandatory community service orders, which would require the supermarket to fund a registered food/meal service charity.

The ACCC is seeking similar penalties for Woolworths in separate proceedings.

The trial is expected to continue over the next two weeks.

The Coles case will also serve as a precedent for the trial against Woolworths, which is set to commence in April.

When the watchdog announced it was suing both supermarkets in 2024, ACCC Chair Gina Cass-Gottlieb said, “Many consumers rely on discounts to help their grocery budgets stretch further, particularly during this time of cost-of-living pressures.”

“It is critical that Australian consumers are able to rely on the accuracy of pricing and discount claims.”

Reporting by Emily Donohoe.

A message from CommSec

What are the key elements of a successful investor mindset?

The mindset that matters most when investing:

Successful investing isn’t just about numbers – it’s about how you think. A strong investor mindset helps you stay calm when markets move and avoid hype-driven decisions. Key things to focus on:

Know your “why”: Be clear on what you’re investing for.

Don’t follow the crowd: Fear and excitement can lead to bad calls.

Think long term: Markets move, but patience builds resilience.

Learn as you go: Mistakes happen – the key is learning from them.

Listen to Episode Four of CommSec’s Invest podcast to find out more.

Information is general in nature. Consider the T&C’s and other fees and charges at commsec.com.au before making a decision. Investing carries risk.

A titbit for your group chat

Paramount is sweetening its deal to lure Warner Bros’ shareholders away from closing on its proposed merger with Netflix.

As you might remember, Netflix announced in December it was buying Warner Bros for $US72 billion ($AU102 billion).

Shortly afterwards, Paramount launched what’s called a “hostile takeover bid”. That means Paramount tried to take control without the consent of Warner Bros’ board of directors, instead pitching directly to its shareholders.

Paramount’s initial deal was for $US30 per share, and was worth $18 billion more than Netflix’s.

In response, Warner Bros told shareholders Paramount’s offer was “inadequate,” providing insufficient value, and questioned the studio’s ability to complete the deal.

Paramount submitted an enhanced offering last week to try to gain shareholder support.

The new deal proposal says Paramount will pay the $2.8 billion breakup fee for ending the deal with Netflix.

Paramount would also pay a $0.25 per share “ticking fee” to all shareholders every three months after December 2026 if the deal does not close.

The company says this underscores its “confidence in the speed and certainty of regulatory approval for its transaction.” It also addresses some of Warner Bros’ concerns by offering to wear the cost should the deal fall through.

Warner Bros has asked its shareholders to vote on the Netflix transaction by April.

Both deals would still need government approval before becoming final.

Reporting by Lachlan Keller.

TDA asks